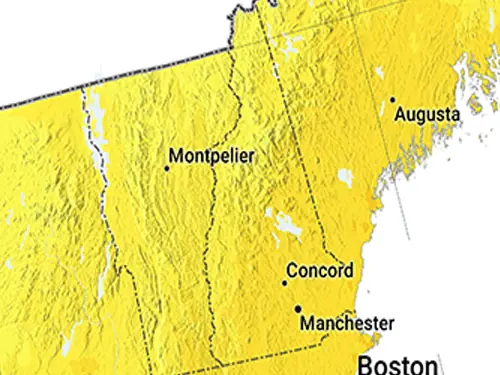

Embrace the Potential of Solar Energy in New Hampshire!

Welcome to New Hampshire, a state celebrated for its picturesque landscapes and strong sense of community, and now emerging as a key player in the solar energy movement. Despite its diverse weather patterns, New Hampshire receives ample sunshine throughout the year, making it an ideal location for solar power generation. This untapped resource offers an exciting opportunity for residents and businesses to adopt clean, renewable energy solutions. With incentives available to offset installation costs and a growing interest in sustainability, New Hampshire is poised for a solar revolution. Explore how harnessing solar energy can illuminate your property, lower energy bills, and contribute to a greener environment right here in the Granite State. Join us in harnessing the power of the sun and take a step towards a brighter, more sustainable future in New Hampshire.

Explore Your Rooftop's Solar Potential

Discover how much solar energy your rooftop can generate. Enter your address below: