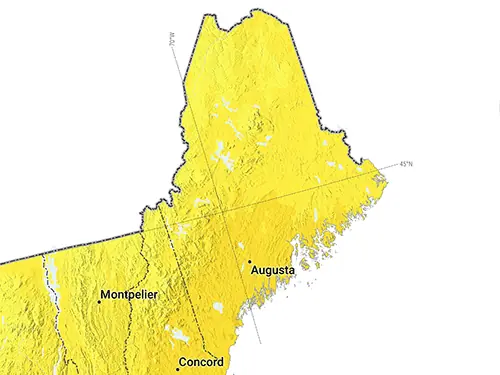

Discover the Power of Solar Energy in Maine!

Welcome to Maine, a state renowned for its rugged coastlines, dense forests, and now, its growing enthusiasm for renewable energy. Despite its northern latitude, Maine enjoys a significant number of sunny days, presenting a unique opportunity for solar power generation. This untapped potential is a call to action for homeowners and businesses to invest in clean, renewable energy, aligning with Maine?s commitment to environmental stewardship and sustainability. Supported by advantageous incentives aimed at reducing the upfront costs of solar installations and a community that values the preservation of its natural beauty, Maine is on the verge of a solar energy boom. Learn how leveraging Maine?s solar capacity can light up your home, decrease energy expenses, and support a healthier, greener environment in the Pine Tree State. Join us in embracing the sun?s boundless energy and moving towards a brighter, more sustainable future in Maine.

Explore Your Rooftop's Solar Potential

Discover how much solar energy your rooftop can generate. Enter your address below: