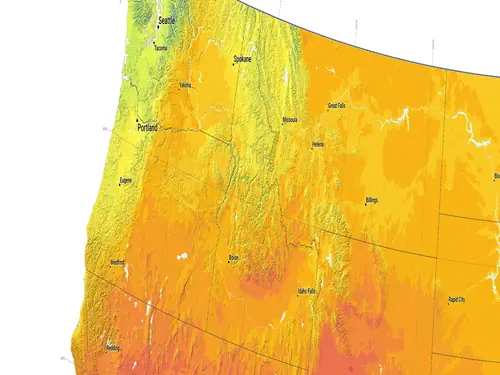

Discover the Power of Solar Energy in Idaho!

Welcome to Idaho, a state celebrated for its stunning mountain ranges, vast wilderness, and now, its emerging role in the renewable energy sector. With a favorable climate that includes many sunny days throughout the year, Idaho presents a promising landscape for solar power adoption. This potential offers a unique opportunity for homeowners and businesses to engage with clean, renewable energy, supporting the state?s commitment to sustainability and environmental preservation. With attractive incentives aimed at reducing the upfront costs and a community increasingly interested in green living, Idaho is poised to make significant strides in solar energy. Learn how tapping into Idaho?s solar resources can brighten your home, cut down on energy costs, and contribute to a healthier environment right here in the Gem State. Join us in harnessing the sun?s boundless energy and moving towards a brighter, more sustainable future in Idaho.

Explore Your Rooftop's Solar Potential

Discover how much solar energy your rooftop can generate. Enter your address below: