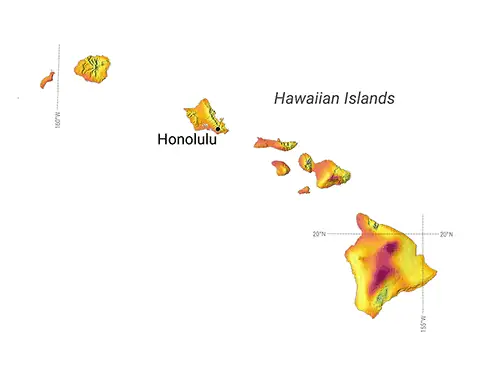

Discover the Power of Solar Energy in Hawaii!

Welcome to Hawaii, a state renowned for its unparalleled natural beauty, vibrant culture, and now, its leadership in the solar energy movement. Blessed with year-round sunshine and a commitment to sustainability, Hawaii offers an ideal environment for solar power generation. This setting presents a unique opportunity for homeowners and businesses to invest in clean, renewable energy, aligning with the state?s goal to become energy independent and reduce its carbon footprint. With strong incentives designed to ease initial costs and a community deeply passionate about preserving their paradise, Hawaii is at the forefront of a solar-powered future. Learn how leveraging Hawaii?s abundant solar resources can illuminate your home, lower energy bills, and help sustain the pristine environment of these beautiful islands. Join us in capturing the sun?s endless power and stepping into a brighter, more sustainable future in Hawaii.

Explore Your Rooftop's Solar Potential

Discover how much solar energy your rooftop can generate. Enter your address below: