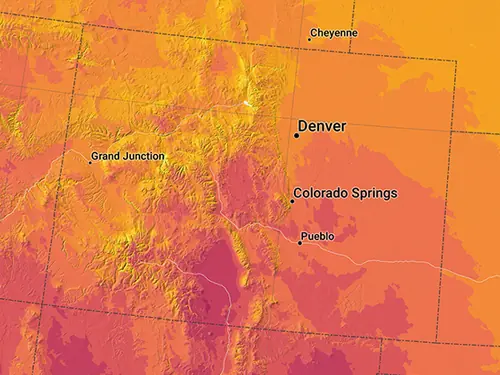

Discover the Power of Solar Energy in Colorado!

Welcome to Colorado, a state known for its majestic mountains, vast plains, and an ambitious stance on renewable energy. Colorado?s unique climate, featuring over 300 days of sunshine a year, makes it an exceptional place for solar power generation. This natural advantage provides a promising opportunity for homeowners and businesses to embrace clean, renewable energy. With competitive incentives to ease the initial setup costs and a community deeply invested in environmental preservation, Colorado is gearing up for a remarkable solar journey. Learn how tapping into Colorado?s abundant solar resources can brighten your home, reduce energy costs, and contribute to a healthier planet right in the Centennial State. Join us in unlocking the sun?s vast potential and stepping into a brighter, more sustainable future in Colorado.

Explore Your Rooftop's Solar Potential

Discover how much solar energy your rooftop can generate. Enter your address below: