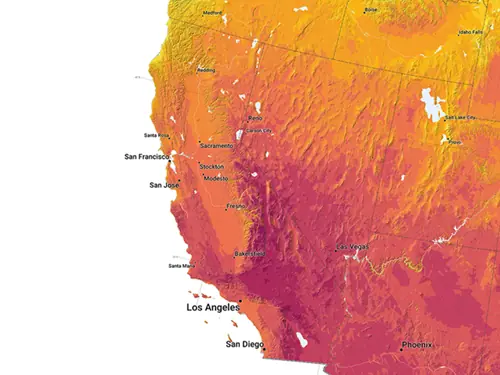

Discover the Power of Solar Energy in California!

Welcome to California, a state known for its diverse landscapes, from beautiful coastlines to expansive deserts, and its leading role in the solar energy movement. California?s abundant sunshine throughout the year makes it an ideal location for solar power generation, placing it at the forefront of renewable energy initiatives. This abundant sunlight offers a compelling opportunity for homeowners and businesses to invest in clean, renewable energy. With robust incentives designed to lessen the upfront investment and a strong community commitment to sustainability, California is steering towards a solar-powered future. Learn how tapping into California?s vast solar potential can illuminate your home, significantly reduce energy costs, and contribute to a more sustainable environment in the Golden State. Join us in harnessing the sun?s infinite energy and step into a brighter, more eco-friendly future in California.

Explore Your Rooftop's Solar Potential

Discover how much solar energy your rooftop can generate. Enter your address below: