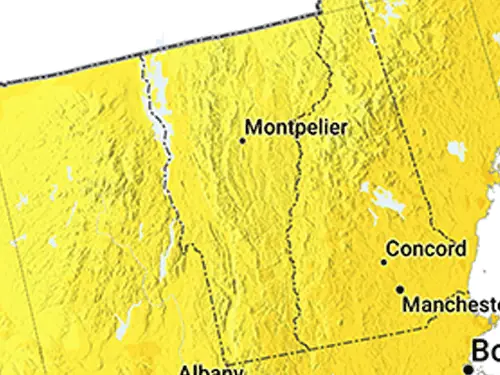

Discover the Power of Solar Energy in Vermont!

Welcome to Vermont, a state cherished for its picturesque landscapes, commitment to environmental stewardship, and a burgeoning interest in renewable energy. Vermont?s forward-thinking energy policies and community support have made it a leader in the solar energy movement, despite its cooler climate. The state benefits from surprisingly ample sunlight, making it an excellent candidate for solar power generation. Vermont offers a range of incentives, including attractive net metering policies and tax credits, aimed at making solar energy accessible and affordable for its residents. This initiative not only assists Vermonters in reducing their energy bills but also plays a crucial role in the state?s ambitious goals for sustainability and reducing carbon emissions. Learn how tapping into solar power can light up your home, lower your environmental impact, and contribute to Vermont?s vision for a cleaner, greener future. Join us in capturing the renewable energy of the sun and stepping into a brighter future in the Green Mountain State.

Explore Your Rooftop's Solar Potential

Discover how much solar energy your rooftop can generate. Enter your address below: