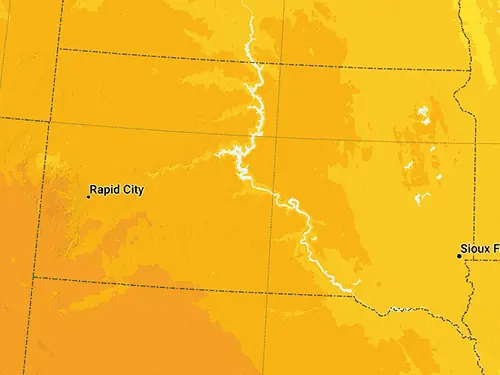

Discover the Power of Solar Energy in South Dakota!

Welcome to South Dakota, a state known for its majestic landscapes, rich cultural heritage, and a growing interest in renewable energy. Amidst the rolling plains and rugged Badlands, South Dakota is exploring the untapped potential of solar power. With an increasing number of sunny days and supportive state policies, solar energy is becoming a viable option for many South Dakotans. The state offers various incentives to encourage the adoption of solar power, aiming to reduce electricity costs and decrease dependency on non-renewable energy sources. Learn how tapping into solar energy can light up your home, lessen your environmental impact, and contribute to South Dakota?s commitment to clean, sustainable energy. Join us in capturing the limitless energy of the sun and stepping into a brighter, more sustainable future in the Mount Rushmore State.

Explore Your Rooftop's Solar Potential

Discover how much solar energy your rooftop can generate. Enter your address below: