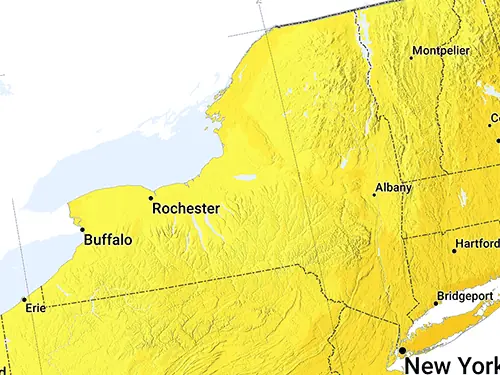

Discover the Power of Solar Energy in New York!

Welcome to New York, a state known for its iconic cityscapes, diverse natural beauty, and now, its growing commitment to solar energy. Despite the hustle and bustle of city life, New York is making significant strides in the adoption of clean, renewable energy sources, with solar power leading the way. The state?s ambitious clean energy initiatives, combined with an increasing number of sunny days, create an ideal environment for solar power generation. New York offers a variety of incentives and programs aimed at encouraging homeowners and businesses to invest in solar energy, making it more accessible and affordable than ever. Learn how converting to solar power can light up your home, bring down your energy costs, and play a crucial role in combating climate change. Join us in embracing solar energy and stepping into a brighter, more sustainable future in the Empire State.

Explore Your Rooftop's Solar Potential

Discover how much solar energy your rooftop can generate. Enter your address below: